Story by Jack Croft

Why are some startups ignoring the SEC?

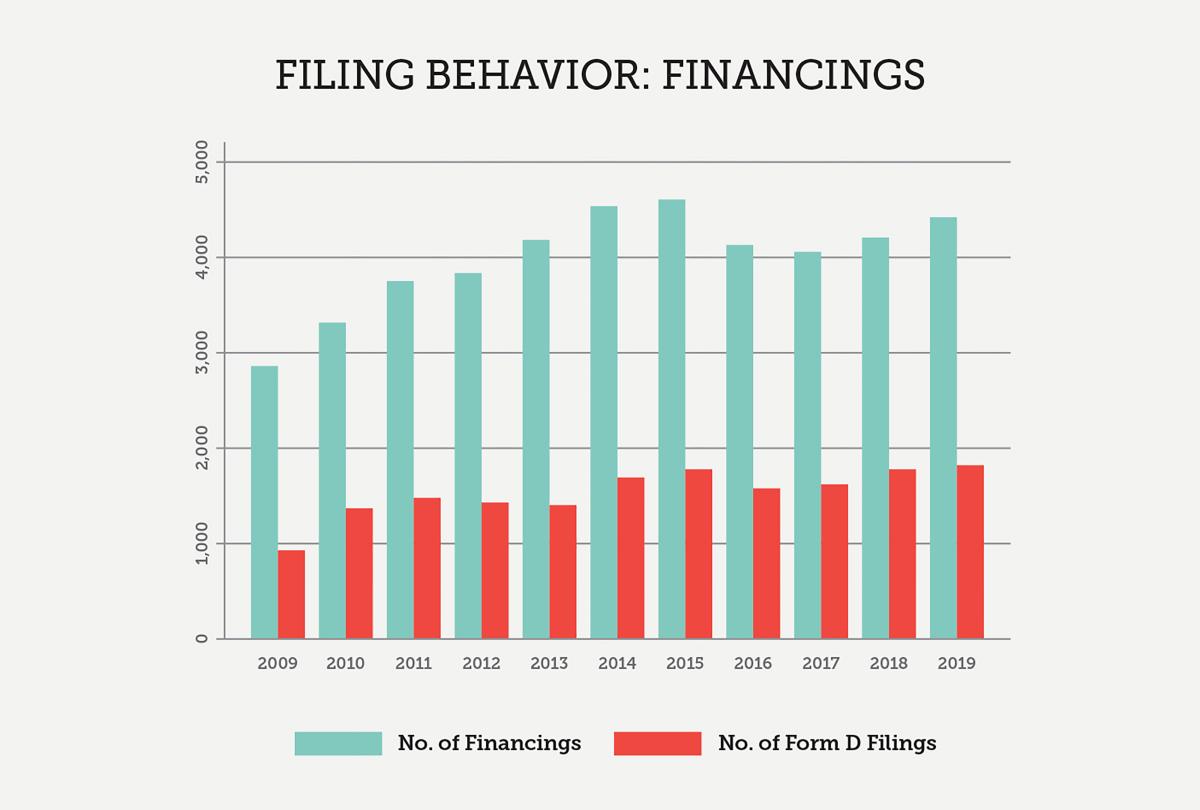

More than half of private firms that raise money from venture capitalists in private markets fail to file a form required by the U.S. Securities and Exchange Commission, according to a recent study by two Lehigh finance professors.

According to their research, these private firms seem to be making a deliberate decision to not file what’s known as Form D, which the SEC describes as “a brief notice that includes basic information about the company and the offering, such as the names and addresses of the company’s executive officers, the size of the offering and the date of first sale.”

“Our conjecture is they are doing that strategically,” says co-author Qianqian Yu, Lehigh Business assistant professor. “They balance the risk of being detected versus the benefit of withholding proprietary information.”

The SEC requires firms to file Form D within 15 days of their first sale of securities to raise capital in private markets. The form helps the SEC monitor the fundraising activities of private firms and is designed to help protect investors, “especially unsophisticated, unaccredited investors,” Yu says.

However, as the study states, “there appears to be little penalty” for not filing.

In the study, “Strategic Regulatory Disclosure: The Case of the Missing Form D,” available on SSRN, Yu and Kathleen Weiss Hanley, the Bolton-Perella Endowed Chair in finance and director of the Center for Financial Services at Lehigh Business, relied on the limited data that is available and anecdotal evidence from corporate attorneys and entrepreneurs to suggest why most firms choose not to file the form.

Firms most likely to not file Form D are those still in early stage, particularly in an industry shown to have high proprietary information such as high tech, biotech and pharmaceutical firms.

Companies most likely to file the form are those that would find it difficult to “fly under the radar” from SEC detection due to the large amount of capital they’re trying to raise, the number of investors, the geographic dispersion of investors and media attention.

One adverse consequence of filing the form that Yu and Hanley were able to document with data is the role of “patent trolls,” who target those firms filing a Form D for litigation more frequently than companies not filing.

Patent trolls are people who, over time, accumulate numerous patents by purchasing them from other patent holders or in other ways, Yu says. But they don’t use the patents to produce products or provide services.

“All they want to do is hold the patents and then sue other companies saying, ‘OK, your service or your product infringes my patents.’ So, they’re trying to profit purely from initiating patent litigations,” Yu says.

Patent trolls primarily target firms that appear to have deep pockets, as indicated by disclosure on the form of how much capital they are raising.

“Just to clarify, we’re not claiming that’s the only adverse consequence or that’s the most important one,” Yu says, “but it is one consequence we have excellent data for.”

In addition to protecting proprietary information and avoiding patent trolls, the study suggests several other reasons firms may choose not to file, including:

- Avoiding attracting attention from regulatory authorities.

- Believing that even the minimal disclosure requirements of Form D are too burdensome or costly.

- Avoiding getting spammed by companies offering loans, products or services.

Why it Matters

Widespread non-compliance in filing Form D hinders the SEC’s ability to monitor private markets to determine whether private offering restrictions designed to protect investors, such as a prohibition on general solicitation or excessive sales to non-accredited investors, are violated.