Story by Jack Croft

Image by Shutterstock/Naphat_Jorjee

Andrew Olenski’s research suggests the owners may be ‘tunneling’ their profits.

It was a puzzle, says Andrew Olenski, assistant professor of economics at Lehigh Business whose current research focuses

on the nursing home industry.

On the one hand, more than half of nursing homes in a given year have been reporting to government regulators that they were actually losing money, in an industry where only 30 percent of nursing homes are nonprofits. Many have said they were on the verge of bankruptcy and faced closing their doors unless reimbursements were increased and minimum staffing levels raised.

“But at the same time, there is this flood of private equity investment into this industry,” Olenski says. “Lots of money pouring in and not at discounted prices.”

When nursing homes come on the market, the average private equity acquisition is about $10 million for a 100-bed facility, he says. Over the years, the exit rate—or number of nursing homes closing—has only been around 1% to 2% annually.

“Nursing homes are being bought up by private equity at extremely high prices. Yet, the facilities claim to be unprofitable,” Olenski says.

Working with co-author Ashvin Gandhi of UCLA, Olenski set out to solve the puzzle by analyzing public records filed with state regulators in Illinois. These public records provided detailed, audited data on “related parties”—when the owner of a nursing home also owns another company or companies that do business with the facility.

Olenski and Gandhi found there has been widespread “tunneling,” a practice where nursing home owners shift profits from their nursing homes primarily to real estate and management firms they also own. The nursing home owners increase by about 40 percent the amount the nursing home pays in rent to the adjacent real estate or management firm. Additionally, fees for management services are inflated by about 25 percent, the researchers found.

“What we found is quite shocking: most profit in the nursing home industry appears to be flowing through one of these related parties,” Olenski says.

In their study, “Tunneling and Hidden Profits in Health Care,” published by the National Bureau of Economic Research, Olenski and Gandhi estimated that 63 percent of nursing home profits were hidden by tunneling them to other companies with the same ownership in 2021.

The hidden profits identified in the study would be equivalent to a 29% increase in Registered Nurse staffing in nursing homes, Olenski says.

The researchers chose to examine records in Illinois because regulators in that state have been collecting data about related parties for two decades, attempting to track nursing home owners who try to hide profits through tunneling. Federal regulators and other states currently do not require reporting on related parties that do business with nursing homes.

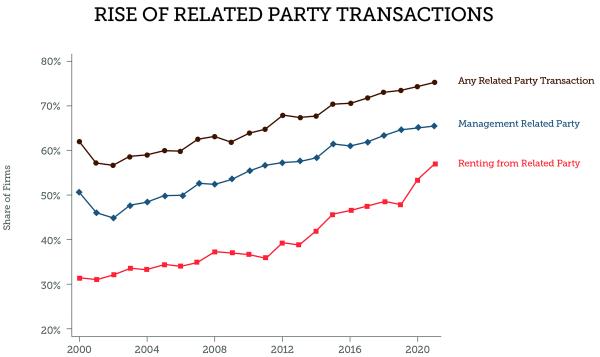

The practice of tunneling continues to grow. Olenski and Gandhi started with data from 2000, when just 30 percent of nursing homes were renting their facility from a related party. By 2020, they found that a little more than 55 percent of nursing homes were paying a related firm rent for their facility.

“These results suggest that the scope for hidden profits in this industry is massive, and requires more detailed financial data on nursing homes and their related parties to uncover exactly where the money flows,” Olenski and Gandhi wrote in the study’s conclusion.

Why it Matters

Financial transparency, including an understanding of true profitability, is essential to setting reimbursement rates and quality standards, Olenski says.

Explore more Lehigh Business faculty research published in top-tier journals.